The Death of Brick and Mortar Retail…Not So Fast!

Greg Conner | 29 June 2017

The retail supply chain is evolving as e-commerce sales climb. But despite all the doom and gloom, traditional brick and mortar stores are still relevant.

Never in our lifetimes have we seen such as change in the retail supply chain. The traditional process of regional distribution centers shipping to brick and mortar stores has been significantly altered by online fulfillment from the likes of Amazon.com and an ever-growing list of online retailers offering direct shipment to our homes. The doom and gloom drums have been pounding for some time now, professing the ultimate demise to traditional brick and mortar stores as we know them.

Over the past few years, I can hardly remember a day where I didn’t read about a large brick and mortar retailer closing stores and citing the increased competition from online retailers. Big box stores like Target, Wal-Mart, and Macy’s will soon be a thing of the past, right?

Not so fast… In a new shakeup to the ever-changing retail supply chain, some traditionally online retailers are beginning to sell their products through brick and mortar stores. Recently, Target has partnered with Harry’s and Bevel to bring formerly online only, subscription based men’s razor products to its shelves.

The move seems to be working as Target claims its market share in men’s shaving products has grown by double digits since bringing on the two lines. Target also recently announced the move to partner with online mattress company, Casper. As of this month, Casper is available in Target stores, a move that Target expects to have similar positive market share gains as experienced with Harry’s and Bevel.

Reaching New Customers

So why would growing companies like Harry’s, Bevel, and Casper want to expand away from their very successful online-only business model? The answer is simple: They want more customers and strive to reduce the cost of going to market. Despite all the buzz about online retailers such as Amazon.com and how fast they are growing, online purchases only account for about 10% of total U.S. purchases.

To maintain the rapid growth that these companies and their investors expect each year, online retailers must find ways to reach more consumers. In addition to Harry’s, Bevel, and Casper, Amazon.com has opened its first brick and mortar book store in New York City. The e-commerce giant also recently made waves with its purchase of Whole Foods and has suggested it might open brick and mortar locations to support furniture sales. One must ask, how far away are we from being able to shop at an Amazon distribution center?

Shipping Costs

Another important driver pushing online retailers towards brick and mortar is the ability to reduce supply chain costs. Freight is by far the biggest cost for online retailers. It goes without saying the cost of shipping a pallet worth of goods to a single store versus a single item directly to someone’s home is significantly less. In order to stay price competitive, online retailers must shrink their margins in comparison to traditional brick and mortar stores.

Another important driver pushing online retailers towards brick and mortar is the ability to reduce supply chain costs. Freight is by far the biggest cost for online retailers. It goes without saying the cost of shipping a pallet worth of goods to a single store versus a single item directly to someone’s home is significantly less. In order to stay price competitive, online retailers must shrink their margins in comparison to traditional brick and mortar stores.

Specifically speaking, the “last mile” expense of home delivery is the most costly. Brick and mortar operations can eliminate or significantly reduce this expense by offering products in their stores or making items purchased online available for pick up in store. Wal-Mart boasts that approximately 90% of the U.S. population lives within 10 miles of one of its locations. What an incredible tool this could be in linking online and store operations.

The Never-Ending Returns Battle

Online retailers face a never ending and extremely expensive battle with returns. The National Retail Federation estimates that 8% of total online sales are likely to be returned, and it’s a rate that is expected to grow. Many online retailers go as far as to encourage customers to buy several pairs of shoes in different sizes and colors to see which ones they like best.

The convenience offering for the customer comes at a significant expense to the supply chain. Brick and mortar operations offer additional savings potential for returns. By having customers bring returned product back to a brick and mortar location, the retailer now has the potential to restock shelves in that store with the returned merchandise or combine it with other returned items from the store already being shipped back to the DC.

Increasing Product Visibility

An additional advantage of offering online products in brick and mortar stores is increased product visibility and the potential to capture impulse buys. Target claims that after the first few months of sales in its brick and mortar stores, Harry’s now equates for nearly 50% of Target’s razor handle sales. To draw attention to the Harry’s product line, Target invested big time in in-store displays.

An additional advantage of offering online products in brick and mortar stores is increased product visibility and the potential to capture impulse buys. Target claims that after the first few months of sales in its brick and mortar stores, Harry’s now equates for nearly 50% of Target’s razor handle sales. To draw attention to the Harry’s product line, Target invested big time in in-store displays.

When it first launched in Target’s 1,800 stores last August, Harry’s displays included larger-than-life, four-foot-tall razors. Earlier this year, those were swapped out for a cutout of a guy in boxer shorts and tube socks standing in front of a mirror with a dog at his feet. It’s been so popular that Target has reported some customers have even tried walking out of the store with the display. It’s certainly very hard to have this type of exposure on the internet.

The Evolution of Retail

What we are seeing is a continued evolution of the retail supply chain. With the success Target has seen with Harry’s, Bevel, and Casper, it’s a forgone conclusion that other growing online retailers will look to make the jump to brick and mortar in order to reach additional consumers and reduce costs.

The biggest challenge facing retailers today isn’t the decision to combine online and brick and mortar sales and distribution channels, but rather how to support and execute this. Failure to move quickly can result in significant setbacks for companies. The recent closure of HH Gregg is a perfect example of a company failing to adapt quickly to a changing supply chain.

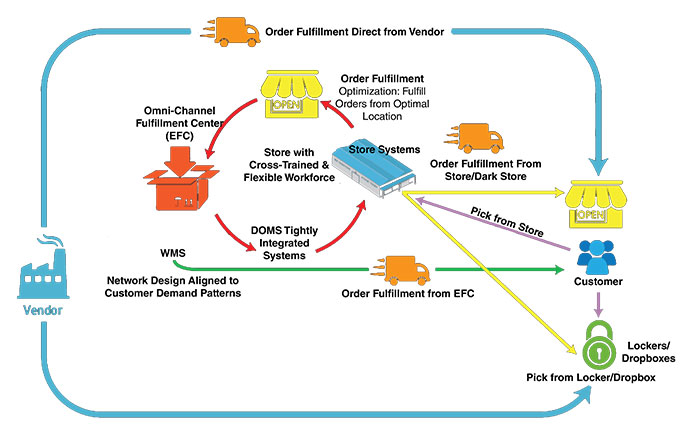

Managing inventory and demand throughout the supply chain will be critical and is beyond the capabilities of most ERP and WMS solutions today. In order to be effective, traditional warehouse functionality will need to occur at the store level. Processes typically directed by the WMS, such as returns, putaway, and picking, will need to occur within each store and be reported in real time.

To accomplish this feat, robust, scalable, and very flexible software systems such as Bastian Solutions’ Exacta intralogistics software suite will need to be utilized. Exacta combines proven warehouse functionality with cutting-edge technology such as augmented reality. There is no doubt that the retail supply chain is evolving. The question is will you and your company be ready to evolve with it?

Contact us today to discuss how Bastian Solutions can help you transform your retail supply chain.

Learn more about our order fulfillment solutions.

Greg is the SVP of Corporate Development and Marketing at Bastian Solutions. A proud Purdue University graduate, at Bastian he works to identify and drive strategies to propel the company forward. His responsibilities include identification of emerging technologies, forming strategic partnerships and M&A activities and execution of the strategic planning process. He carries with him years of experience in the field, having previously worked as a project engineer, field application engineer and regional director of Indiana.

Comments

No comments have been posted to this Blog Post

Leave a Reply

Your email address will not be published.

Comment

Thank you for your comment.